what is suta tax rate

This taxable wage base is 62500 in 2022 increasing from 56500 in 2021. An additional Medicare tax rate of 09 is applicable to the threshold amount mentioned.

State Unemployment Tax Act Suta Tax Rates 123paystubs Youtube

Please click here for details.

. If youre unsure contact the agency at 800 891-6499. Your SUTA tax rate falls somewhere in a state-determined range. SUTA Rate Notices For 2022.

Get updated SUTA rate from your state. States assign your business a SUTA tax rate based on industry and history of former employees filing for unemployment benefits. If youre a new employer follow the steps below to find out your SUTA rate.

You can also find your SUTA Account Number on any previously filed quarterly contribution and payroll report. You can find your Employer Tax Rate by logging into your Indiana Uplink account. State Unemployment Taxes SUTA An employees wages are taxable up to an amount called the taxable wage base authorized in RCW 5024010.

December 3 2021 Larry the Payroll Guy. Sign up for a SUTA tax account with your state. SUI is a fund that pays out unemployment benefits wage replacements to an employee who has lost their job through no fault of their own and who is seeking new employment.

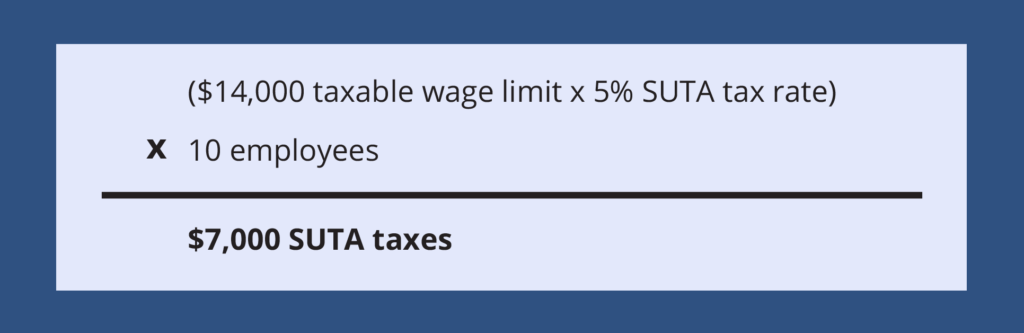

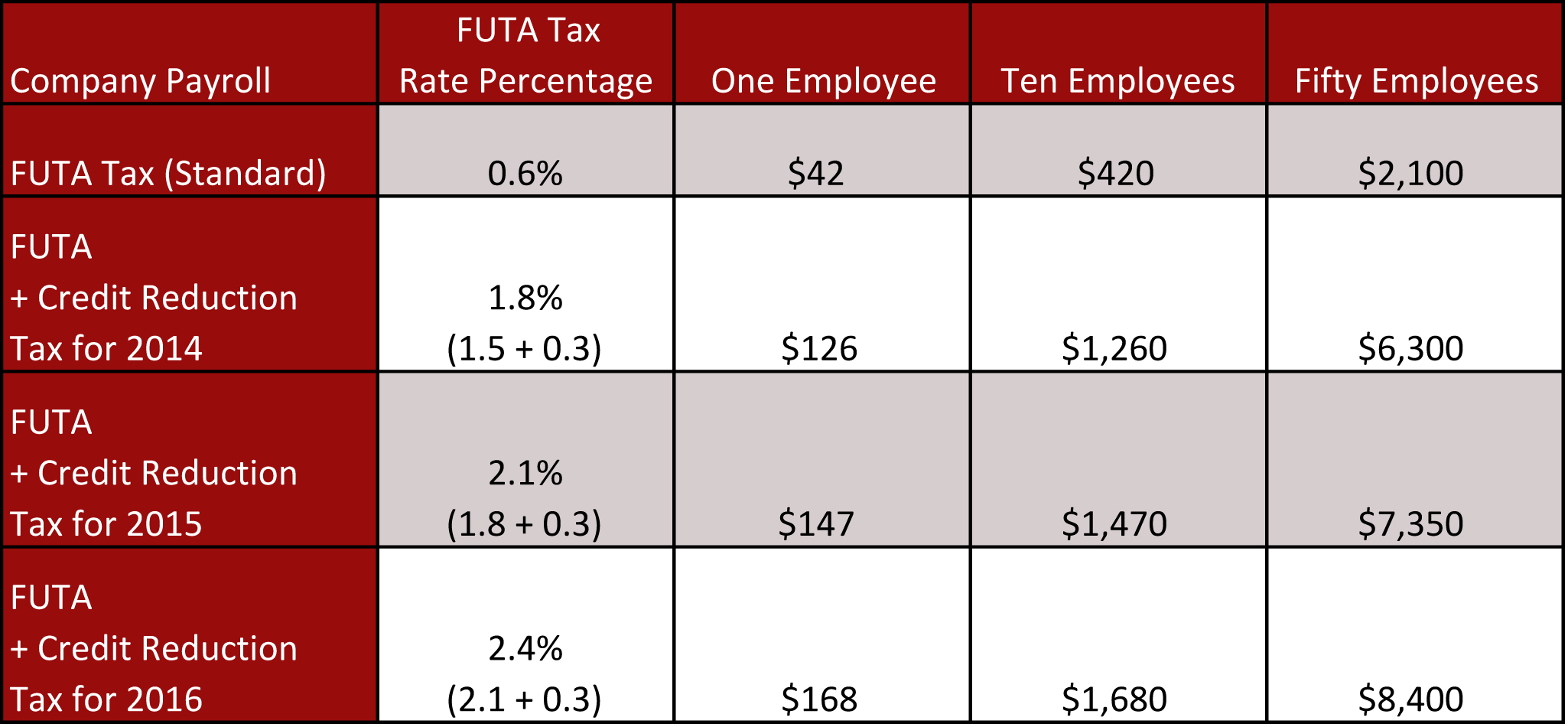

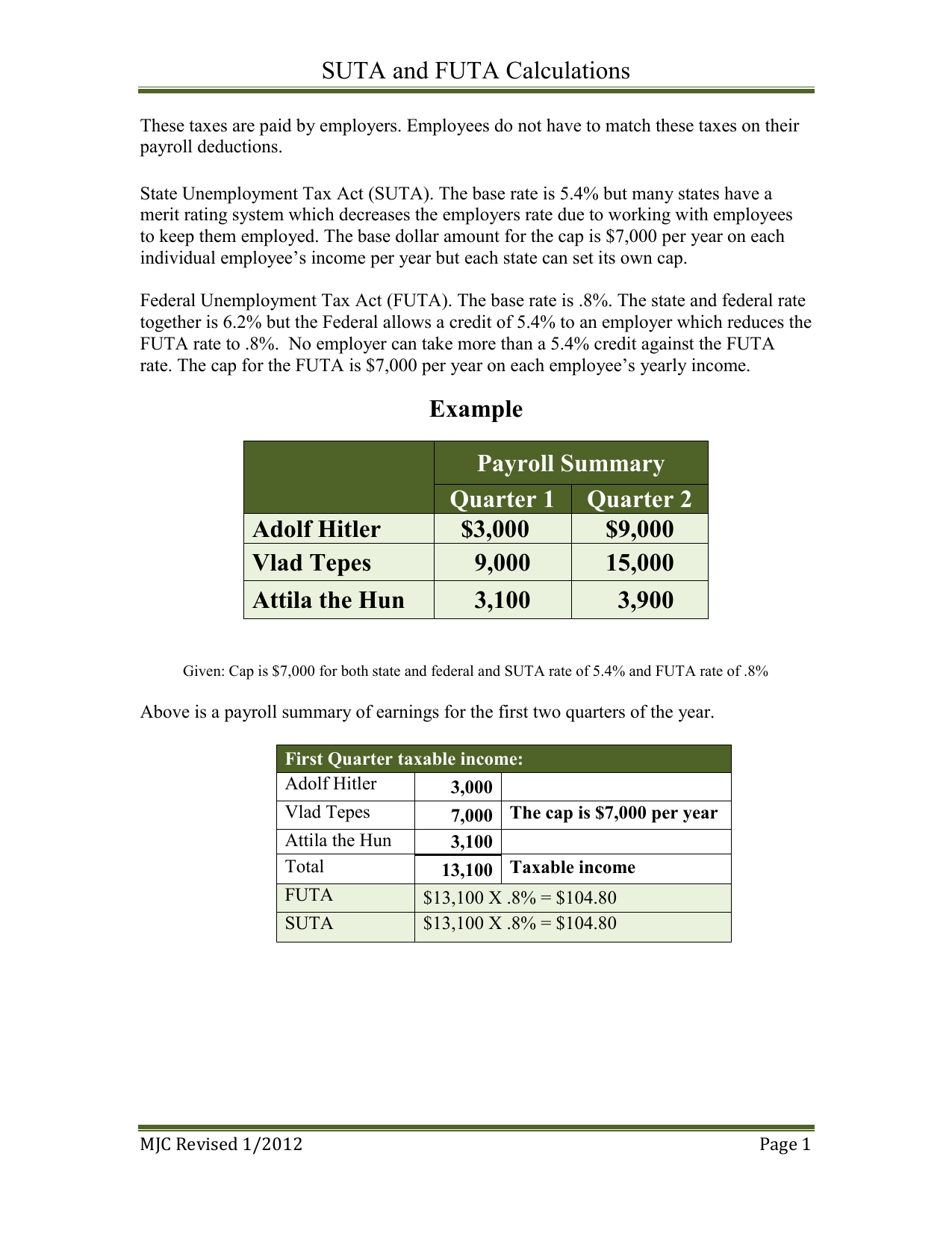

SUTA State Unemployment Tax Act. The State Unemployment Tax Act SUTA quite similar to the FUTA tax is to fund the state unemployment program that benefits people who lose their job. Experience tax currently capped at 54 Annual tax calculation based on the ratio of benefit claims of former employees charged to the employer and taxable.

Tax Rate Information. New to Online Filing. Indiana Employer Tax Rate.

Tax agencies in other states will be sending these notices soon if they havent already. The 2021 new employer rate was 021 percent. The Indiana Department of Workforce Development recently mailed out 2022 Merit Rate Notices to all applicable Indiana employers.

Now lets get into what SUI actually is. You can also find your Employer Tax Rate on the Merit Rate Notice mailed to you by the Department of. The latest Employer Advisor is now available.

2021 New Employer rate - 095. A general business employer with gross payroll of at least 1500 in any calendar quarter or with at least one worker in 20 different weeks during a calendar year. The State Unemployment Tax Act SUTA.

Employers contribute to this program and in some states employees are also required to contribute to. Unemployment insurance tax is a tax on employer payrolls paid by employers from which unemployment benefits are paid to qualified unemployed workers. 8th Lowest Tax Rate For Employers.

You run a non-construction business. Taxable Wage Base - 24600 per employee 26100 for those employers that have an experience rate of 959 or higher 2022 Tax Rate - 021 percent 00021 The Job Development Fund Assessment will be 021 percent for calendar year 2022. Here are steps that you and AccuPay need to take to ensure accurate tax.

Say youre a new employer in Kentucky. You are required to pay taxes if you are. Receive new employer contribution rate from the state.

In most but not all states. Please click here for details. Employers pay taxes into this fund.

Please click here to read it.

Glencoe Mcgraw Hill Payroll Taxes Deposits And Reports Ppt Download

Futa Suta Unemployment Tax Rates Procare Support

Futa Tax Overview How It Works How To Calculate

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

What S The Cost Of Unemployment Insurance To The Employer

Futa Federal Unemployment Tax Act San Francisco California

Oed Unemployment Ui Payroll Taxes

Payroll Taxes Deposits And Reports Section 2 Unemployment Tax And Workers Compensation Chapter 11 Section Objectives 6 Compute And Record Ppt Download

Calculate Employer S Total Futa And Suta Tax As Tclh Chegg Com

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor

What Is Futa Tax 2021 Tax Rates And Information

Systems Understanding Aid 9th Edition Suta And Futa Calculations

.jpg)