does draftkings provide tax forms

Goldman Sachs Says Put Your Money On Draftkings Penn National Never Got Tax Form From Fanduel Draftkings Please Help R Dfsports Paying Tax On Your Sports Betting. Key tax dates for DraftKings - 2021 Where can I find my DraftKings tax forms documents 1099 W-2G.

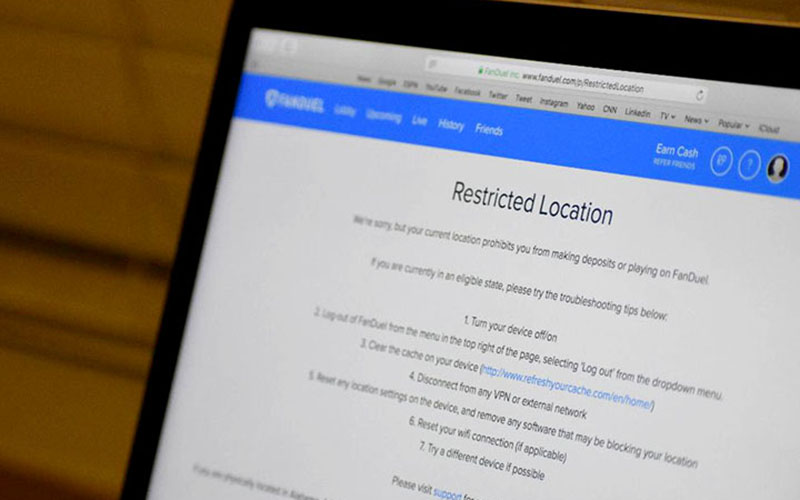

Daily Fantasy Sports Irs Memo Potentially Earth Shattering For Draftkings Fanduel Boston Business Journal

Only when you have a wager meeting.

. For legal sportsbooks a taxable event is considered a 600 net profit at 300 to 1 odds on a winning wager. FanDuel sent me a tax form just the other day dont use draftkings so Im not sure how they go about it. If you qualify to receive tax forms from DraftKings IRS Forms 1099W-2G you can access the information directly from the Document Center.

Draftkings 1099 form for 2021. Never got tax form from fanduel draftkings please help r dfsports paying tax on your. As sports begin a slow return daily fantasy sports companies could potentially owe millions more in taxes due to new government guidance.

If it turns out to be your lucky day and you take home a net profit of 600 or more for the year playing on. Entrants may be requested to complete an affidavit of eligibility and a liabilitypublicity release unless prohibited by law andor appropriate tax forms and forms of identification including. Please advise as to where I input.

Mile_High_Man 3 yr. The only place I see where a 1099-MISC is applicable is Small Business Self employed which is not what my DRAFTKINGS form is from. If you strike lucky and you take home a net profit of 600 or more for the year playing in sportsbooks such as DraftKings the operators have a legal duty to send both.

You can expect to receive your tax forms no. Why am I being asked to fill out an IRS Form W-9 for DraftKings. Its stated in the tax section on every app.

You may need to access your account so you can get your DraftKings tax form. DraftKings shall use commercially reasonable efforts to process requests for withdrawal within. You will be required to provide your business name or full name tax classification ie.

Fantasy sports winnings of at least 600 are reported to the IRS. Fan Duel sent me mine via e-mail about a week ago.

How To Pay Taxes On Sports Betting Winnings Bookies Com

Draftkings Unveils Promotions For Kansas Launch Gamblingnews

Draftkings Begins New Era With Official Launch Of Sportsbook In New Jersey Business Wire

Gambling Winnings How Playing Fantasy Sports Affects Your Taxes

Draftkings Shares Slump On News Of Irs Daily Fantasy Tax Spotty Q2 Financials Deadline

Draftkings Raises A Stink About Massachusetts Online Gaming Proposal Boston Business Journal

Mass Senate Passes Sports Betting Bill Wbur News

Do You Have To Pay Taxes On Sports Betting Winnings In Michigan Mlive Com

Dfs Players Operators Brace For Impact Of Latest Irs Tax Ruling

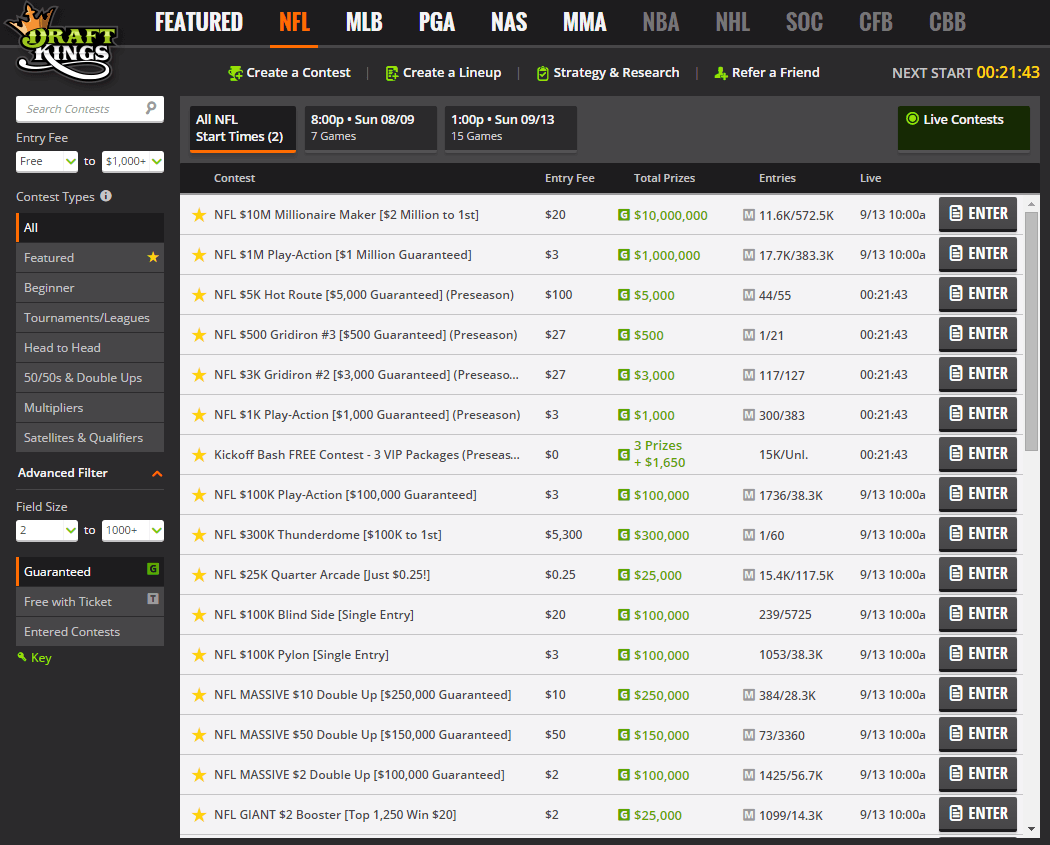

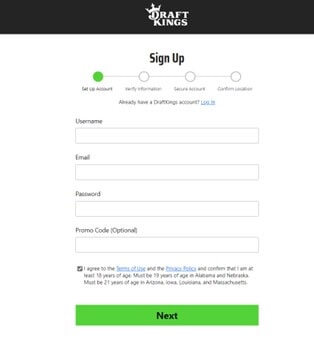

How To Open A Draftkings Account Sign Up In 5 Quick Steps

Draftkings Fanduel Ask Judge To Stop Schneiderman Politico

Is Draftkings Dkng Stock A Buy Or Sell As The Nfl Season Starts Seeking Alpha

Daily Fantasy Sports And Taxes Dissecting The 1099s

Draftkings Fanduel Put 20 Million Into Sports Betting Initiatives

On Tax Day An Extension May Be Better Than Rushing A Return Cleveland Com

See Blenderhd S Tweet On Twitter Twitter

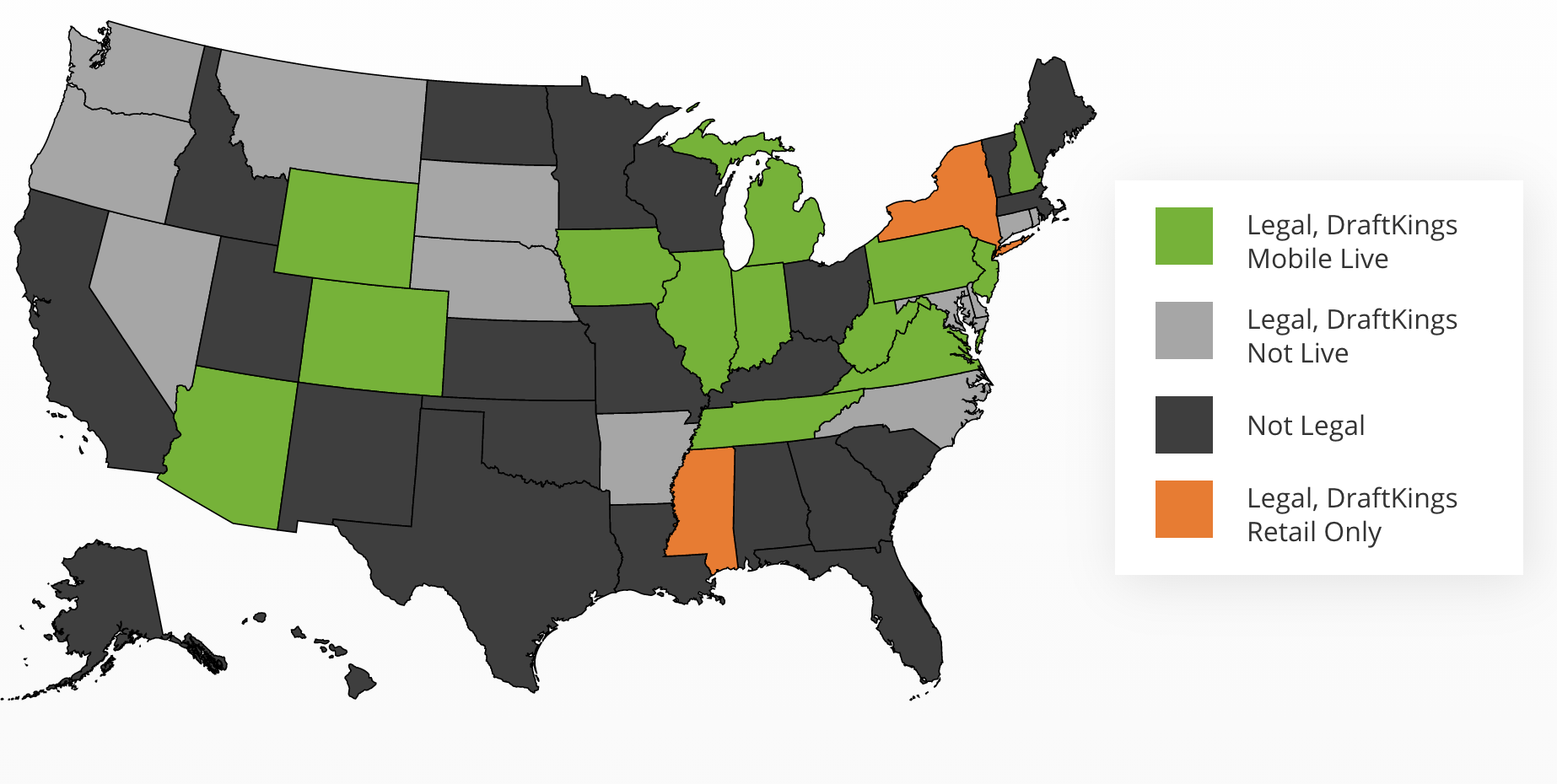

When It Comes To Daily Fantasy Sports Sites Arizona On Outside Looking In Cronkite News