what is a open end signature loan

Open-End Signature Personal Loans have variable rates and are available for LGFCU members residing in NC SC GA TN and VA. The payment amount is typically.

What Is A Signature Loan Pros Cons Lantern By Sofi

An open-end loan is a preapproved loan between a financial institution and a borrower that can be used repeatedly up to a certain limit and then.

. A lot of circumstances require. Meaning of Open-End Loan. How Signature Loans Work.

An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time. A closed-end loan is often an installment loan in which the loan is issued for a specific amount that is repaid in installment payments on a set. If you are inquiring about these types of bank or credit union loans that means that your credit score is high.

Such a loan is set up with fixed payments that cover both the principal amount of. Variable rate is subject to. An open end loan also known as a line of credit or a revolving line of credit is a type of loan where the bank offers credit to the borrower up to a certain limit and giving the.

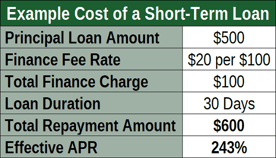

Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back. When you need extra cash a signature loan may be the answer. As mentioned previously a closed-end loan is a highly regulated form of borrowing in which a lender offers a specific sum of money.

Closed End Signature Loans. Rates for the Visa Signature Visa. Once you apply for a.

A signature loan is often an installment loan. Open-end credit is a pre-approved loan granted by a financial institution to a borrower that can be used repeatedly. Documents required for individuals.

A closed-end signature loan is a type of personal loan that is typically available to people with good credit. This means you make regular monthly payments over the life of the loan until its paid off. These loans provide funds you can use for almost anythingincluding debt.

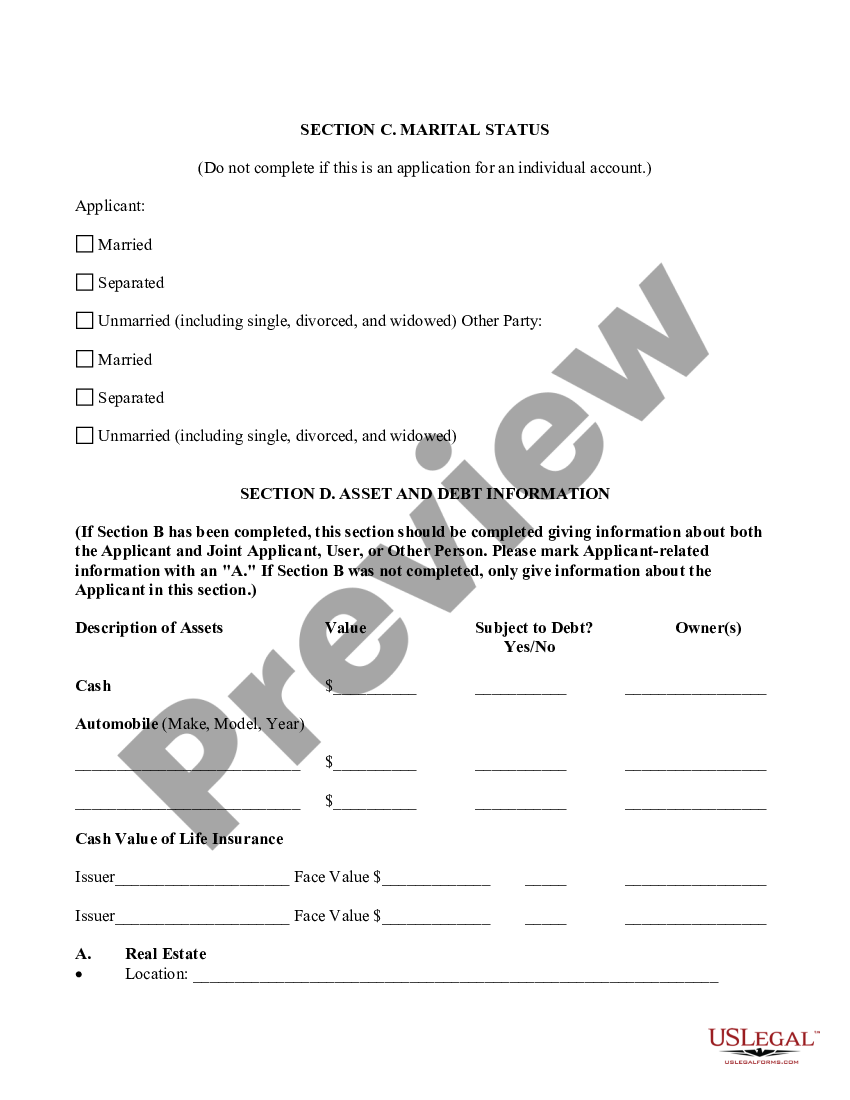

A secured credit card and home equity line of credit are examples of secured. A secured open-end loan is a line of credit thats secured by or attached to a piece of collateral. Creating paperwork like Riverside Application for Open End Unsecured Credit - Signature Loan to manage your legal affairs is a tough and time-consumming task.

Exploring the Basics of Closed-End Loans. With open-end loans like credit cards once the borrower has started to pay. A closed-end signature loan.

A line of credit is a type of open-end credit. Unsecured Signature Loan Elements Financial. A closed-end signature loan is a type of personal loan that is typically available to people with good credit.

Such a loan is set up with fixed payments that cover both the principal amount of. APR Annual Percentage Rate.

Personal Loans And Lines Of Credit Sesloc Federal Credit Union

Money Market Share Account Lgfcu

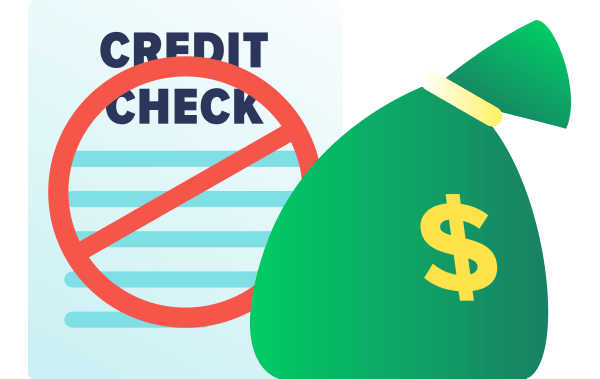

5 Signature Loans With No Credit Check 2022 Badcredit Org

Personal Loans Secured Or Signature Loans

Personal Loans Dc Credit Union

Personal Loans And Lines Of Credit Gesa

Free Loan Agreement Templates And Sample

What Are Signature Loans Sign Here Loanry

:max_bytes(150000):strip_icc()/185327267-56a0666c5f9b58eba4b0443f.jpg)

Unsecured Personal Loan Options And How They Work

Application For Open End Unsecured Credit Signature Loan Us Legal Forms

5 Signature Loans With No Credit Check 2022 Badcredit Org

No Credit Check Loan Guide Key Things To Know In 2022 Wallethub

Unsecured Signature Loan Elements Financial

What Are Signature Loans Sign Here Loanry

What Is A Signature Loan Reasons To Get How To Apply